Are Service Contracts Taxable In Colorado . Business services impacted by taxation: while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. are services taxable in colorado? Contractors who perform construction work on real property are. Colorado doesn’t generally impose sales tax on services. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. Colorado taxes retail sales of tangible personal property (tpp) and select. current law in colorado. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales.

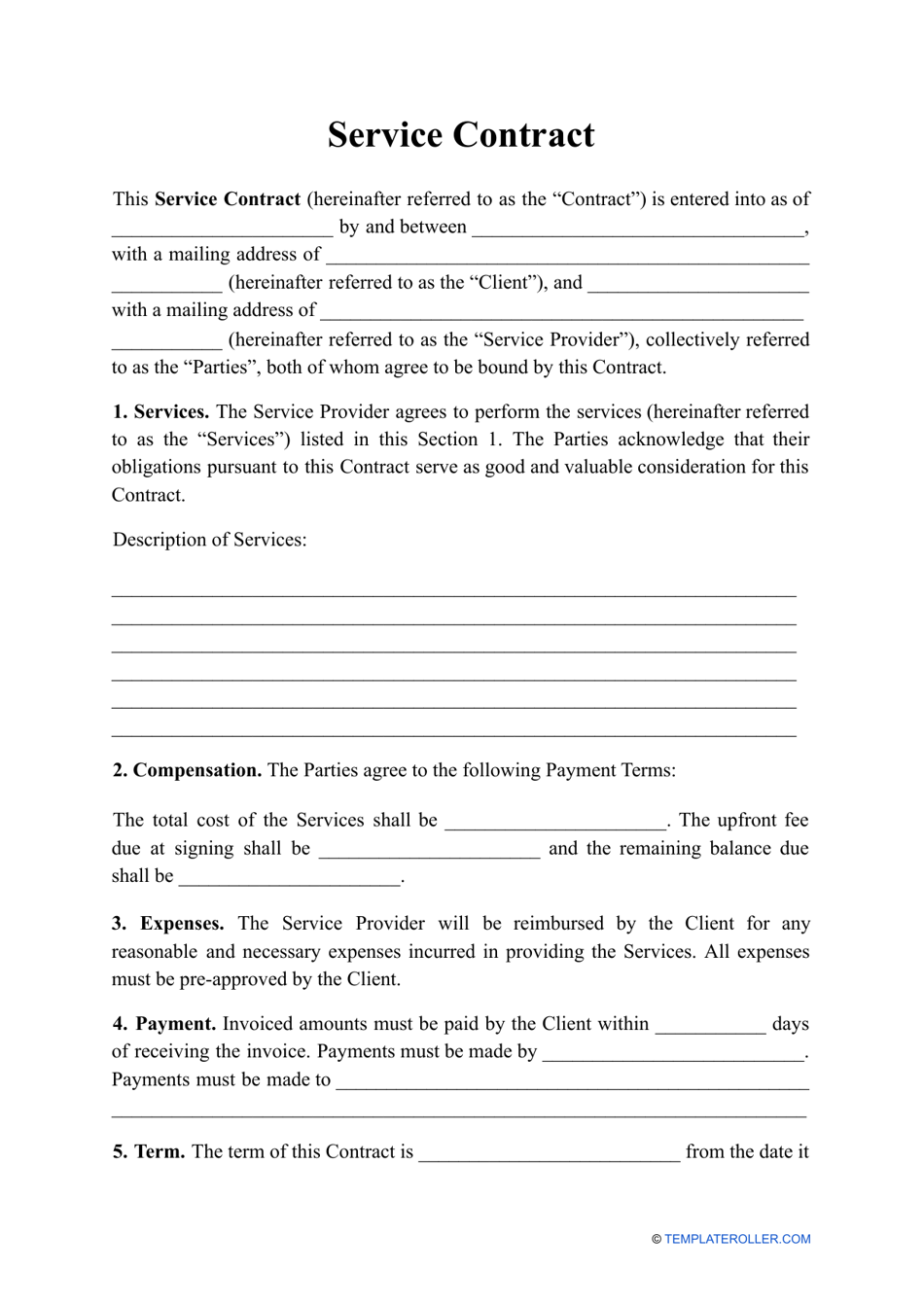

from www.templateroller.com

while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Contractors who perform construction work on real property are. current law in colorado. Colorado taxes retail sales of tangible personal property (tpp) and select. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. are services taxable in colorado? Colorado doesn’t generally impose sales tax on services. Business services impacted by taxation: for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales.

Service Contract Template Fill Out, Sign Online and Download PDF

Are Service Contracts Taxable In Colorado this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. Contractors who perform construction work on real property are. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Colorado taxes retail sales of tangible personal property (tpp) and select. are services taxable in colorado? Business services impacted by taxation: current law in colorado. Colorado doesn’t generally impose sales tax on services. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing.

From www.sampleforms.com

FREE 4+ Legal Services Contract Forms in PDF MS Word Are Service Contracts Taxable In Colorado current law in colorado. Colorado doesn’t generally impose sales tax on services. Colorado taxes retail sales of tangible personal property (tpp) and select. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for. Are Service Contracts Taxable In Colorado.

From www.templateroller.com

Colorado Contract for Deed (Land Contract) Fill Out, Sign Online and Are Service Contracts Taxable In Colorado Colorado doesn’t generally impose sales tax on services. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. Contractors who perform construction work on real property are. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. Colorado taxes retail. Are Service Contracts Taxable In Colorado.

From eforms.com

Free Professional Services Agreement Samples PDF Word eForms Are Service Contracts Taxable In Colorado Business services impacted by taxation: current law in colorado. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. are services taxable in colorado? Colorado doesn’t generally impose sales tax on services. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased. Are Service Contracts Taxable In Colorado.

From www.dexform.com

SERVICE CONTRACT Sample in Word and Pdf formats Are Service Contracts Taxable In Colorado are services taxable in colorado? Colorado taxes retail sales of tangible personal property (tpp) and select. current law in colorado. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many. Are Service Contracts Taxable In Colorado.

From legaltemplates.net

Colorado Employment Contract Template PDF & Word Are Service Contracts Taxable In Colorado are services taxable in colorado? Colorado taxes retail sales of tangible personal property (tpp) and select. Business services impacted by taxation: Contractors who perform construction work on real property are. current law in colorado. Colorado doesn’t generally impose sales tax on services. while colorado's sales tax generally applies to most transactions, certain items have special treatment in. Are Service Contracts Taxable In Colorado.

From eforms.com

Free Cleaning Service Contract Template PDF Word eForms Are Service Contracts Taxable In Colorado for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. current law in colorado. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Business services impacted by taxation: are services taxable in colorado? this page. Are Service Contracts Taxable In Colorado.

From legaltemplates.net

Free Construction Contract Template PDF & Word Are Service Contracts Taxable In Colorado Colorado doesn’t generally impose sales tax on services. Business services impacted by taxation: Colorado taxes retail sales of tangible personal property (tpp) and select. Contractors who perform construction work on real property are. are services taxable in colorado? while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. . Are Service Contracts Taxable In Colorado.

From esign.com

Free Colorado Employment Contract Templates PDF Word Are Service Contracts Taxable In Colorado Colorado taxes retail sales of tangible personal property (tpp) and select. Contractors who perform construction work on real property are. Colorado doesn’t generally impose sales tax on services. are services taxable in colorado? this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. current law in colorado. Business services. Are Service Contracts Taxable In Colorado.

From www.examples.com

10+ Electrical Contract Example Templates Word, Docs, Pages Examples Are Service Contracts Taxable In Colorado for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. Colorado doesn’t generally impose sales tax on services. are services taxable in colorado? Colorado taxes retail sales of tangible personal property (tpp) and select. Contractors who perform construction work on real property are. current law in colorado.. Are Service Contracts Taxable In Colorado.

From eforms.com

Free Employment Contract Templates PDF Word eForms Are Service Contracts Taxable In Colorado are services taxable in colorado? current law in colorado. Colorado doesn’t generally impose sales tax on services. Contractors who perform construction work on real property are. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. while colorado's sales tax generally applies to most transactions, certain. Are Service Contracts Taxable In Colorado.

From eforms.com

Free Colorado Land Contract Template PDF Word eForms Are Service Contracts Taxable In Colorado Contractors who perform construction work on real property are. Colorado doesn’t generally impose sales tax on services. Colorado taxes retail sales of tangible personal property (tpp) and select. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. are services taxable in colorado? for maintenance agreements which are. Are Service Contracts Taxable In Colorado.

From www.dexform.com

Service Contract in Word and Pdf formats Are Service Contracts Taxable In Colorado this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. Contractors who perform construction work on real property are. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. Colorado doesn’t generally impose sales tax on services. while colorado's. Are Service Contracts Taxable In Colorado.

From www.typecalendar.com

Free Printable Residential Service Contract Examples [PDF] Are Service Contracts Taxable In Colorado are services taxable in colorado? for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. Contractors who perform construction work on real property are. Business services impacted by taxation: Colorado taxes retail sales of tangible personal property (tpp) and select. Colorado doesn’t generally impose sales tax on services.. Are Service Contracts Taxable In Colorado.

From www.dexform.com

Example of SERVICE CONTRACT in Word and Pdf formats Are Service Contracts Taxable In Colorado Colorado taxes retail sales of tangible personal property (tpp) and select. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. current law in colorado. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use in performing. Business services impacted by. Are Service Contracts Taxable In Colorado.

From www.firstintegritytitle.com

2024 Contract Date Guide First Integrity Title Company Are Service Contracts Taxable In Colorado Contractors who perform construction work on real property are. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Business services impacted by taxation: this page describes the. Are Service Contracts Taxable In Colorado.

From www.pandadoc.com

What is a Service Contract, Types and Examples Pandadoc Are Service Contracts Taxable In Colorado current law in colorado. for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. are services taxable in colorado? Colorado taxes retail sales of tangible personal property (tpp) and select. this page describes the taxability of optional maintenance contracts in colorado, including parts purchased for use. Are Service Contracts Taxable In Colorado.

From templatelab.com

40 Great Contract Templates (Employment, Construction, Photography etc) Are Service Contracts Taxable In Colorado Colorado taxes retail sales of tangible personal property (tpp) and select. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Contractors who perform construction work on real property are. Business services impacted by taxation: Colorado doesn’t generally impose sales tax on services. current law in colorado. for. Are Service Contracts Taxable In Colorado.

From juro.com

service agreement template free to use Are Service Contracts Taxable In Colorado for maintenance agreements which are mandatory and part of the purchase price of the item, the vendor must collect sales. Colorado doesn’t generally impose sales tax on services. are services taxable in colorado? Colorado taxes retail sales of tangible personal property (tpp) and select. current law in colorado. Business services impacted by taxation: while colorado's sales. Are Service Contracts Taxable In Colorado.